ITR-INCOME TAX RETURN

Types and Uses of ITR is vital and compulsory, Have it with Lowest | Affordable | Fair price with Leegal

Practical Consultancy

Financial Advice

Our Expertise

Experienced & Trusted

SERVICES

ITR-INCOME TAX RETURN

Know all about ITR Forms and their role in determining your overall tax liability

ITR Form Basics

Understand the fundamentals of ITR forms.

ITR 1 ITR 2 ITR 3 ITR 4 ITR 5 ITR 6 ITR 7Every taxpayer must know all the ITR forms details and file the ITR before the specified due date to avoid penalties. The applicability of ITR forms depends on the amount of the income earned, sources of income of the taxpayer, and the category the taxpayer belongs to, such as individuals, HUF, and company.

ITR Form Details

Learn more about ITR form types available.

ITR-1 Form or SAHAJThis form is for resident Indians who fall under the below-mentioned categories:1. If income is created from a pension or salary2. If income is created from single house property, however, in case the losses have been carried forward from the previous year, the exclusion is allowed.3. In case the income is generated from agriculture (not more than Rs.5,000)4. The total income produced can be a maximum of Rs.50 lakh and not more5. Income that has been created from other sources such as lottery or winning horse races

Individuals who fall under the following groups cannot opt for ITR-1:1· If the total income created is more than Rs.50,0002· In case individuals have taxable capital gains3· In case income is created from more than one house property4· During the financial year, if any investments were made in unlisted equity bonds6· If you are an NRI (Non-Resident Indian) or RNOR (Resident Not Ordinary Resident)7· In case there is an income produced from agriculture more than Rs.5,0008· In case income is produced from profession or business9· In case the taxpayer is the director of a company10· In case any income is created from a property located abroad11· In case an individual possesses foreign income or foreign assets.

ITR 4 Form Details

Eligibility of ITR 4 for Individuals and Businesses

Digital signatures are easily transportable.Digital signatures cannot be duplicated by someone else.The scheme ensures that the sender cannot deny it

The below-mentioned taxpayers and HUFs are not allowed to opt for ITR-4:1. In case the gross income generated is higher Rs.50 lakh2. In case any losses have been carried forward from previous years3. In case the taxpayer has a signing authority at a place outside India4. In case any investments were made in equity bonds unlisted at any time during the financial year5. In case taxpayers have generated a foreign income or foreign assets6. In case the income has been produced from more than one house property7. In case the taxpayer is the Director of a company8. In case the taxpayer is an NRI or an RNOR

Mobile Number

We Provide ITR-INCOME TAX RETURN Pan INDIA

Applicant Aadhar

Documents Required For Digital Signature

Applicant PAN CARD

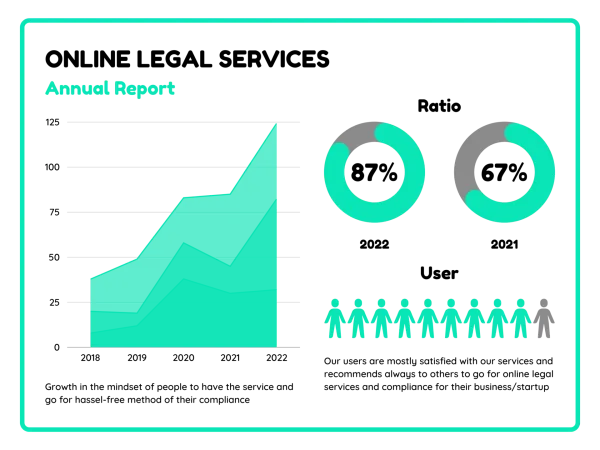

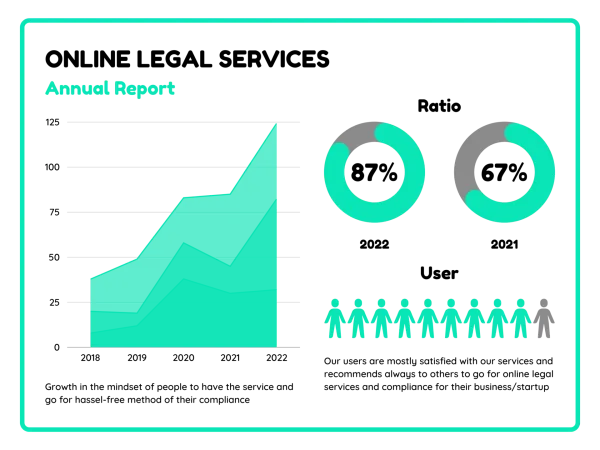

Growth capability is a system's ability to scale and adapt, meeting increasing demands and evolving needs for long-term success.

Have Your Acknowledgment In 30min

Tailor the platform to your needs, offering flexibility and control over your user experience.

Starting From Rs.499

WHY CHOOSE ME

24/7 Availability

Round-the-clock assistance is available, ensuring issues are resolved quickly, keeping your operations running smoothly.

What sets us apart?

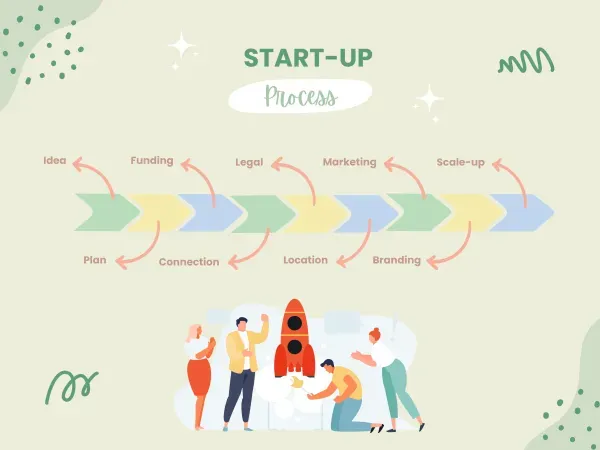

Startup freindly ecosytem. Empower the work ability of entrepreneur across the areas of Taxation, Finance and Legality.

New businesses should have benn contacted Leegal because of its pricing freindly and co-operation values.

Way beyond approch to resolve their clients problems and issues with various Departments

Harshad Agarwal

CEO & Founder

Virendra Thakur

Director

Akal Oraon

Contractor

TESTIMONIALS

What My Clients Say?

CALL NOW FOR FREE CONSULTAION

Have Your DSC NOW !